ROSEVILLE, Mich. (WXYZ) — Back-To-School supplies continue to rise and are costing parents hundreds of dollars. But there could be some hope when it comes to catching a break.

Notebooks, pens, clothing, electronics, and backpacks: the prices of those items just keep on climbing.

This is Ashley Bertand. She has three children, and they just made one of multiple trips for school supplies.

"This was $196 with the barebone minimum with pulling out for last year," Bertand said. "Crossing off what we could re-use and that is only two of them at the list age...it's not a huge number at the end of the day, but that could be an extra excursion to something fun."

Stephanie Elso told me she has spent $200-300 on school supplies so far this summer.

"My daughter is going into preschool right now things add up," Elso said. "I am actually just about to go in for school supplies not only do they need like pencils and crayons but also a water bottle and a lunch box and the teachers are asking for for supplies."

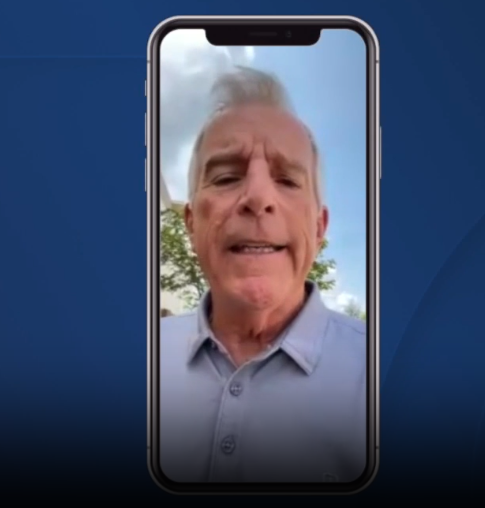

But there could be some hope on the horizon: Rochester Hills State Representative Mark Tisdel introduced Bill 5805 in June. He says this bill aims to bring a tax-free holiday to the state to Back-to-School supplies on the third weekend of August every year on both Saturday and Sunday.

"Everbody has had problems at the cash register," Tisdel said. "Parents could use a break and help getting their kids back to school, and if we can't cut them a little break at the cash register this time of year then when can we cut them some slack?"

Right now, only 20 states have a tax-free holiday for Back-to-School Supplies. According to the National Retail Federation, families with children in elementary school through high school plan to spend an average of $874.68 this year on clothing, shoes, school supplies and electronics.

While this bill may help families with children, there is no estimate on how much revenue the state could gain or lose, but Representative Tisdel says they'll figure it out.

"What we have to do is recognize what is in front of us today and again it's not a huge number," Tisdel said. "It's not a big tax burden for the state of Michigan and there are plenty of places where we can find savings."

Parents I spoke with are hopeful that relief may soon by on the way.

"Anything helps," Bertand said.

"I think it would be helpful with everything being so expensive the last couple of years so any kind of break we could get would be great," said Maria Hernandez.